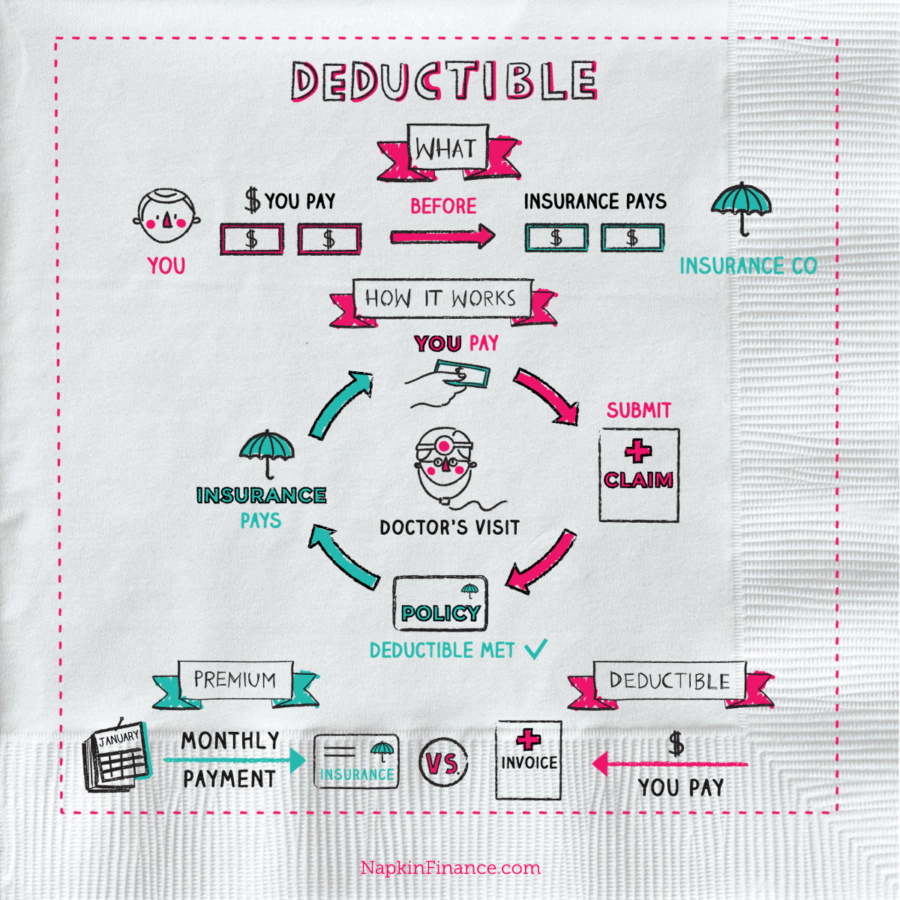

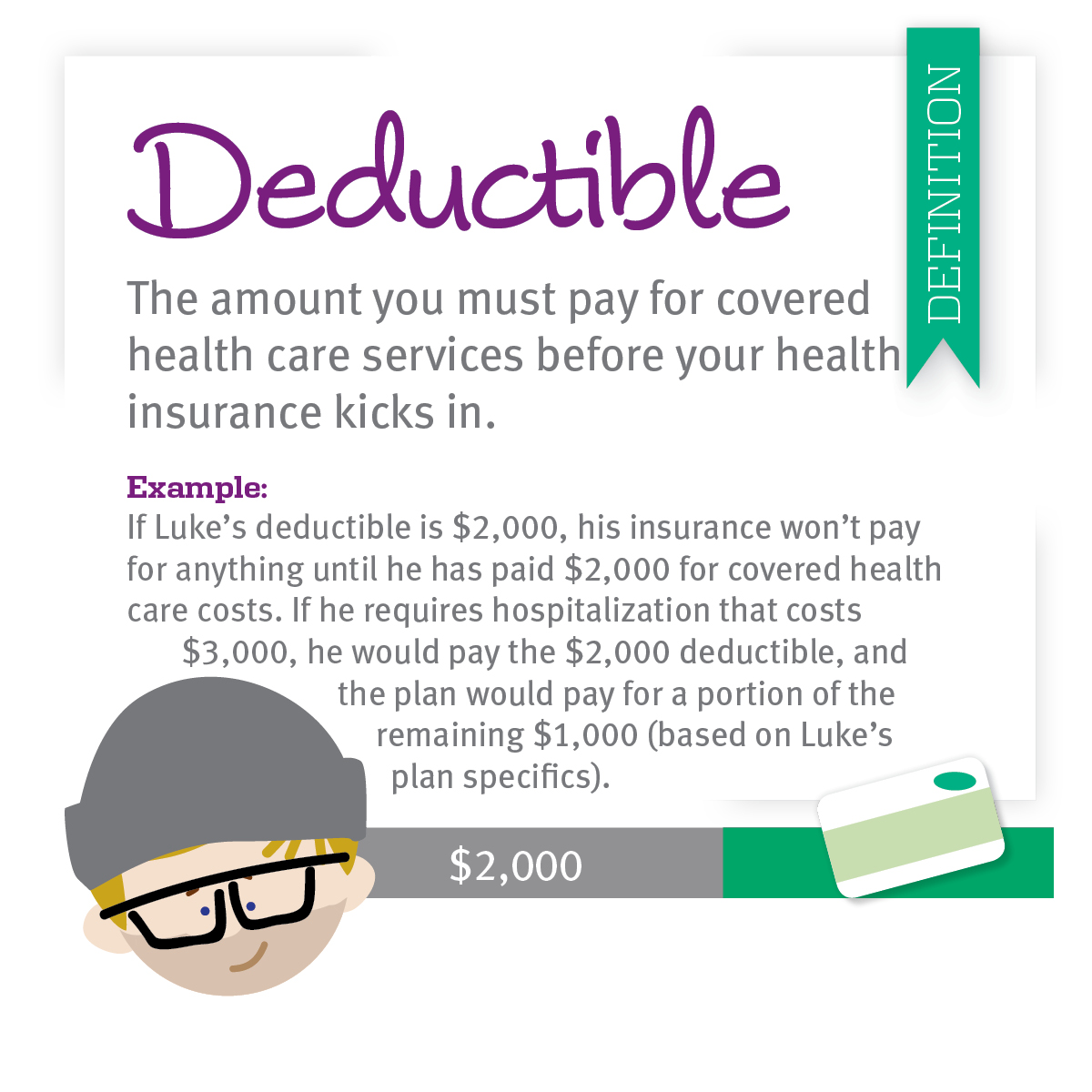

Your health insurance deductible is the amount that you will have to pay annually for your health care (such as surgical procedures, blood tests, or hospitalizations) before the health insurance company pays anything.įor example, if you have a $2,500 deductible and undergo three $1,000 procedures in a year, you will have to pay the full bill for the first two procedures and $500 of the third. Read more: How much insurance should you have? What is a deductible? Health insurance premiums vary greatly depending on what medical expenses the plan covers, which doctors you can see, and how much you’ll have to pay in other ways when you use services. If you purchase your own health insurance plan, you may have the option to pay your premium annually, quarterly, or monthly. If you belong to an employer-sponsored plan, the premium is likely deducted from each paycheck as pre-tax dollars. Your premium is the amount you pay into the insurance plan on a regular basis. Still confused? I’ll explain these terms in more detail below.

Some programs provide comprehensive coverage, which means they cover lots of distinct services, while other programs should fill a particular gap in policy. Payments vary depending on the member’s coverage and the specific policy. The insurance provider collects premiums and pays benefits while the participants pay premiums and receive benefits. How does health insurance work?Īll health insurance plans function in the same way (for the most part). When you make frequent physician visits and do all the recommended screenings and evaluations, you’re more inclined to detect severe conditions that might emerge. It is possible to benefit from many preventive services provided by your insurance plan, designed to keep you healthy. Health care is expensive, but it’s important to remember that h ealth insurance isn’t only for times of illness or injury.

#HEALTH INSURANCE COPAY AFTER DEDUCTIBLE HOW TO#

How To Pay Medical Bills You Can’t Afford.Best Car Insurance For College Students.Should You Get Home Contents Insurance?.How Much Should You Contribute To Your 401(k)?.How Much Do You Need To Have Saved For Retirement?.The Beginner’s Guide To Saving For Retirement.Investment Calculator: How Much Will You Earn?.

How To File A FAFSA As An Independent Student.Best Companies For Student Loan Refinancing in 2022.Best Personal Loans For Excellent Credit.Understanding Overdraft Protection and Fees.Balance Transfer Calculator: How much can you save?.Credit Score Calculator: Get Your Estimated Credit Score Range.

0 kommentar(er)

0 kommentar(er)